Yes, we absolutely can create a new type of PPP and an enhanced framework that strongly supports it that are informed by what we all will have been through once the COVID-19 crisis is over. And I look forward to seeing this unfold. Imad Fakhoury – World Bank.

Introduction

Since March, I have been globally engaged in an ongoing conversation with PPP practitioners both from the public and private sectors about the impact of the COVID-19 Pandemic on PPPs. This topic has also been discussed in initiatives led by the World Association of PPP Units and Professionals (WAPPP), the International Sustainable Resilience Center (ISRC), and PPPHealth4All, organizations that I have leadership roles in. As a result of these discussions, I decided to undertake a simple survey and send a simple questionnaire to PPP professionals, peers, colleagues, practitioners, and friends around the world who are engaged in seeking solutions to a post pandemic world. This survey was not intended to be statistically verifiable study, but more of a structured conversation with practitioners in the field, whether they come from the public or private sectors.

The PPP Survey

The following survey was sent to approximately 1,000 LinkedIn contacts who indicated in their profile that they were involved in PPPs in some or other way. Of the approximately 1,000 invitations sent I received 157 survey responses, a 15% response rate.

Respondents were asked the following questions:

Q 1. What are the two biggest challenges that you are facing in regard to COVID-19 impacts on your PPP projects?

Q 2. What two PPP sectors do you see being the most vulnerable to COVID-19 impacts?

Q 3. What two PPP sectors do you see as being the most promising in a post-COVID-19 era?

Q 4. What help would you most appreciate from development banks, donors, investors, and developers as you move forward with your PPP programs during economic recovery?

Q 5. What positive opportunities do you see the Covid-19 Pandemic creating for a new approach paradigm to PPPs in the next few years?

Responses

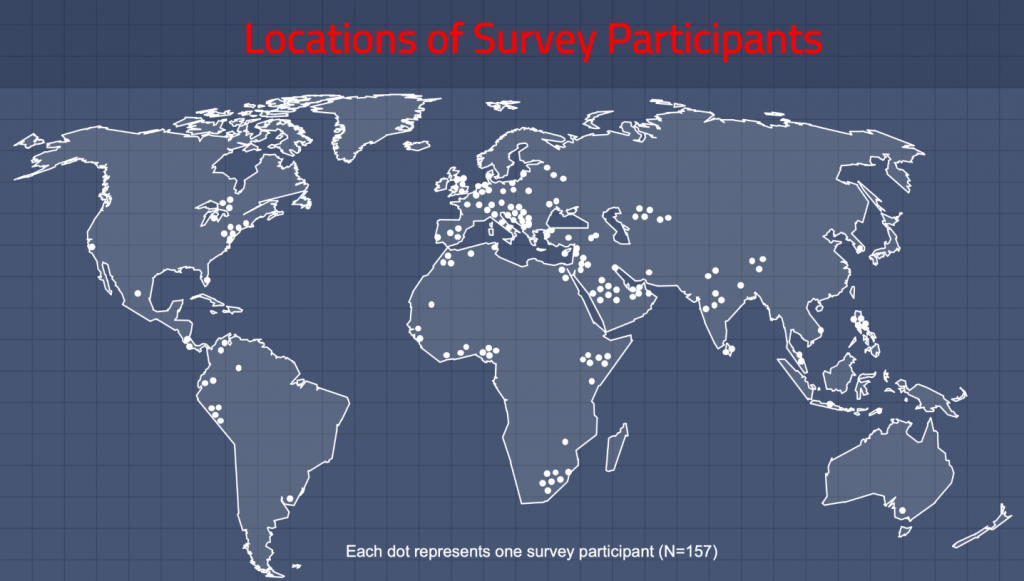

Responses were received from practitioners located in public sector PPP Units and government ministries; the private sector; as well as academic institutions; multilateral banks; and donor organizations) from 69 countries (see figure below).

The countries were the following: Afghanistan; Albania; Algeria; Armenia; Australia; Austria; Belarus; Belgium, Canada; Colombia; Costa Rica; Croatia; Cyprus; Czech Republic; Denmark; Ecuador; Egypt; El Salvador; Estonia; France; Germany; Ghana; India; Indonesia; Iran; Italy; Jordan; Kazakhstan; Kenya; Korea (South); Kosovo; Kuwait; Kyrgyzstan; Lebanon; Malawi; Malaysia; Mauritania; Mexico; Morocco; Nepal; Netherlands; Nigeria; Oman; Peru; Philippines; Poland; Portugal; Russian Federation; Saudi Arabia; Senegal; Serbia; Sierra Leone; South Africa; Spain; Sri Lanka; Switzerland; Tanzania; Timor-Leste; Togo; Tunisia; Turkey, UAE; Uganda; United Kingdom; Ukraine; Uruguay; United States; Uzbekistan; and Vietnam.

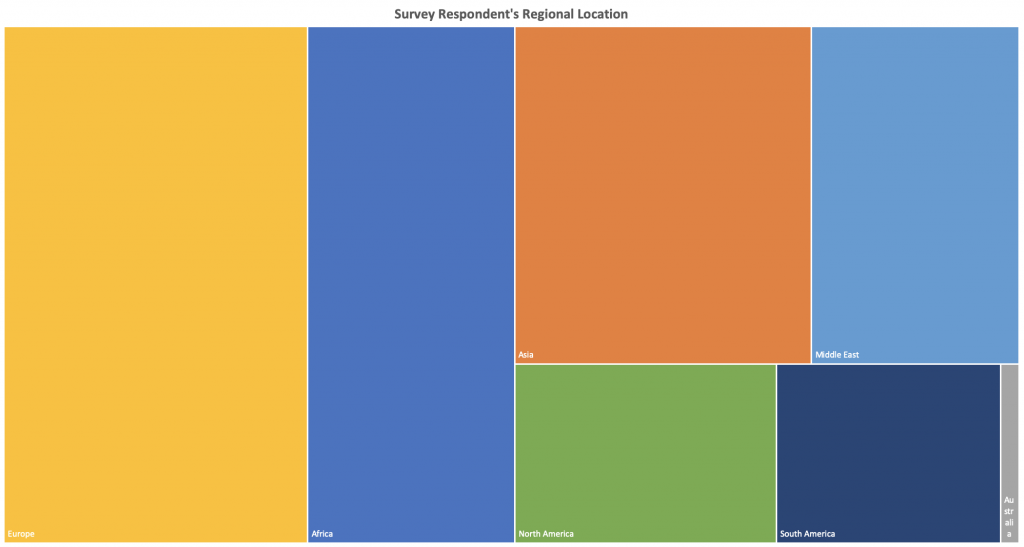

Regionally, the distribution of survey respondents is as follows: Africa 20.4%; Asia 19.1%; Australia 0.6%; Europe 27.4%; Middle East 13.4%; North America 8.9%; and South America 7.6 % (See figure below).

In the following five sections, a summary of the survey feedback is provided.

Question 1: The Biggest COVID-19 Challenges that PPP Projects are Facing

The following challenges (summarized) were identified by the survey respondents:

- Concern about shrinking investor interest in certain types of PPP projects (especially future projects) due to the weakening financial global market and investors’ concerns about project bankability due to declining economic and user activity.

- Concerns about current projects being able to generate revenues and the ability of governments to make availability payments and meet deferred concession payments from the private sector.

- Project risk management and mitigation under pandemic conditions and emerging risk pushbacks.

- Delays in government project procurements / tenders due to changing priorities and timelines.

- A loss of a long-term focus on PPP programs due to a short-term crisis management focus on pandemic mitigation.

- Technical advisors being unable to advise on projects, especially new procurements due to social distancing.

- Concerns on how to address force majeure provisions in contracts (this was the most common concern) in a global pandemic crisis of a scale never seen before.

- Adjusting project contract deliverable expectations due project delays and potential terminations and the cost thereof.

- Practical concerns regarding staff availability, their access to project sites due to health concerns, and project partners being unable to physically meet to discuss project mitigations and recovery strategies.

- Balancing immediate concerns with long-term concerns.

- Accountability to stakeholders and declining project site monitoring (including environmental monitoring).

- Impacts on the balance sheets of investors, particularly where leverage is high.

- Concerns about project liquidity.

- Inflexible legislation (legal frameworks) that is unable to proactively address impacts to PPP projects.

- Excessive public sector bureaucracy preventing proactive reactions to challenges and immediately needed mitigations.

- Interventions by politicians who lack an understanding of PPP’s complexity.

- Impacts to supply chain logistics.

- Long-term perceptions of project profitability in times of pandemic austerity when projects receive support from governments.

Question 2: The PPP Sectors Most Vulnerable to COVID-19 Impacts

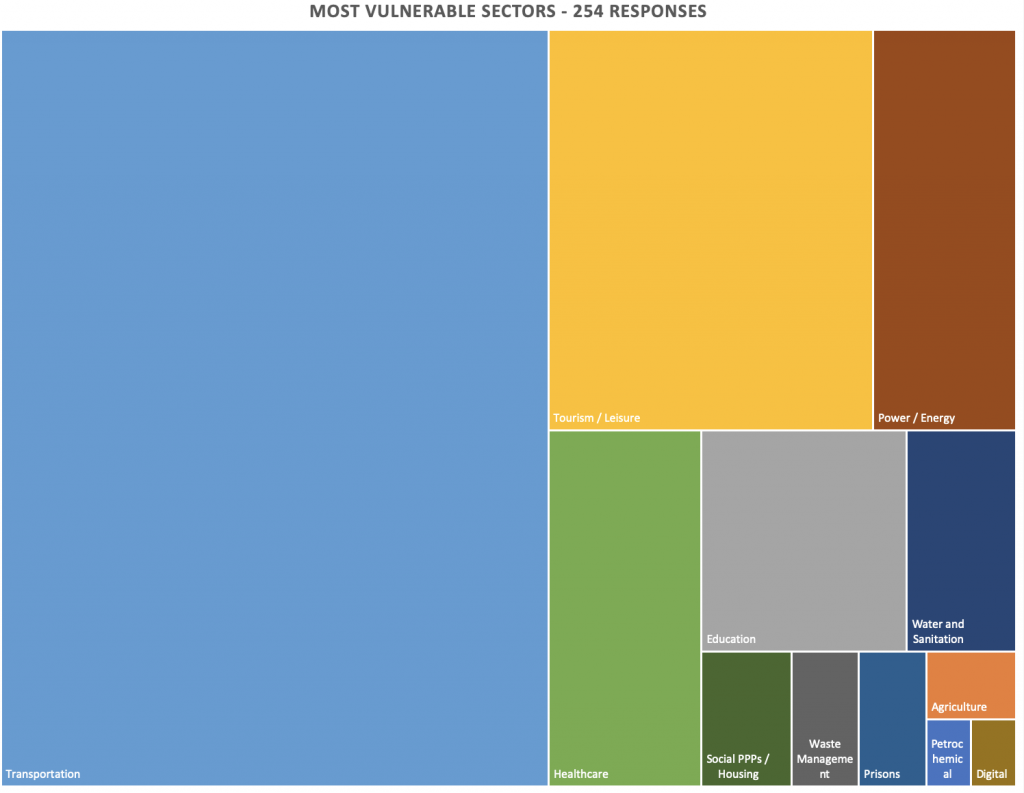

The 157 survey respondents provided 254 responses to the question on which two sectors they felt were the most vulnerable (see figure below).

The most identified vulnerable sectors were as follows in decreasing order: transportation 53.9%; tourism / leisure 16.9%; power energy 7.5%; healthcare 7.1%; education 5.9%; water and sanitation 3.1%; waste management 1.2%; prisons 1.2%; social PPPs 1.2%; agriculture 0.8%; petrochemical 0.4%; digital 0.4%; and social PPPs / housing 1.6%. It must be pointed out that the sectors differed slightly on a continental / regional basis.

Sector vulnerabilities vary between regions. The most mentioned vulnerable sectors by region identified by survey respondents in decreasing order are as follow:

- Africa – transportation; tourism / leisure; power / energy; and healthcare

- Asia – transportation; tourism / leisure; and power / energy

- Australia – education; schools; and transportation

- Europe – transportation; tourism / leisure; healthcare; and education

- Middle East – transportation; tourism / leisure; power / energy

- North America – transportation; tourism; health; power / energy; and education

- South America – transportation; tourism; and education

In the transportation sector, the most commonly mentioned types of vulnerable projects were toll roads, rail; airports; and shipping ports. Additional comments that were made about the sectors most at risk include the following:

- Large scale projects will most likely have to be postponed in lieu of smaller projects in the foreseeable future.

- Transportation projects have suffered the most due to a decline in users, user payments, global trade, and changes in commuter behavior.

- Healthcare projects are facing considerable strain due to the massive increase in users and finite resources.

- Payment guarantees might not be met by governments due to declines in taxation revenues.

- Many projects that are reliant on labor are on hold because of quarantines and this has impacted operations and management activities.

- Utilities are struggling because unemployed users are unable to pay for the services provided.

- Existing PPP legislation has not considered severe pandemic events.

Question 3: PPP Sectors Most Promising in a Post-COVID-19 Era

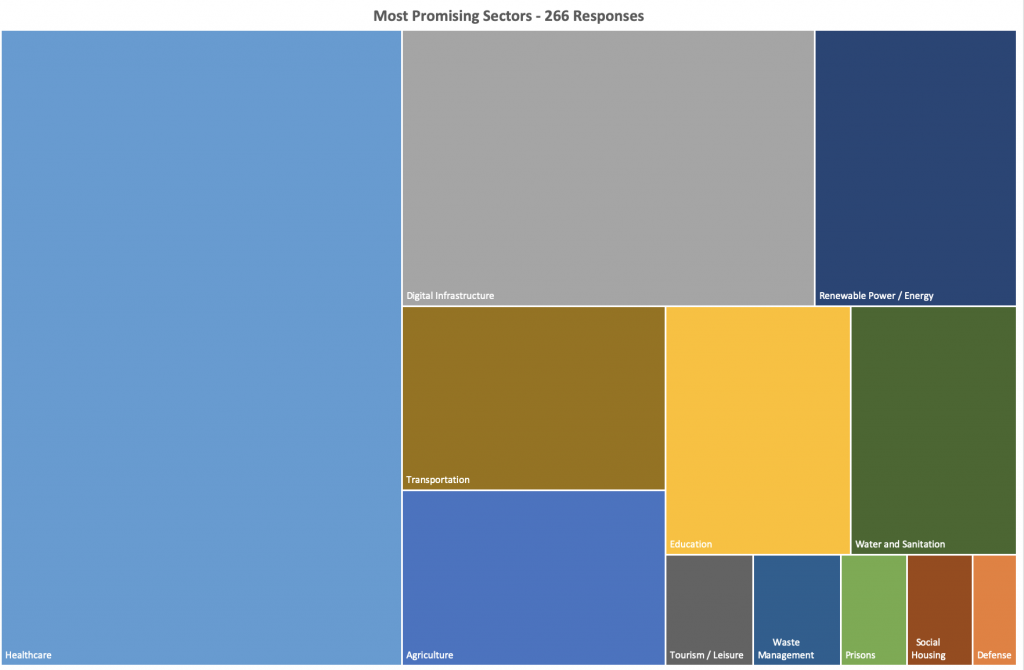

The 157 survey respondents provided 266 responses to the question on which two sectors they felt were the most promising in a post-covid-19 period (see figure below).

The most identified promising sectors were the following in decreasing order: healthcare 39.4%; digital infrastructure 17.7%; renewable energy/power 8.6%; transportation 7.5%; education 7.1%; agriculture 7.1%; water and sanitation 6.4%; tourism and leisure 1.5%; waste management 1.5%; social housing 1.1%; prisons 1.1%; and defense 0.8%.

Sectors with the greatest post-COVID-19 pandemic potential identified by respondents vary between regions. The sectors with the most potential – by region – identified by survey respondents in decreasing order are as follow:

- Africa – healthcare; digital infrastructure; agriculture; renewable energy; and water and sanitation

- Asia – healthcare; digital infrastructure; education; agriculture; and renewable energy;

- Australia – social housing and healthcare

- Europe – healthcare; digital infrastructure; smart transportation; renewable energy; and social housing

- Middle East – healthcare; smart transportation; education; digital infrastructure; and water and sanitation

- North America – healthcare; digital infrastructure; power / energy; and transportation

- South America – healthcare; digital infrastructure; and transportation

It is interesting to note that although healthcare was considered one of the riskiest sectors (See question 2), it is also considered the most promising for future PPPs. This is not surprising due to the awareness that the healthcare sector was woefully unprepared for the impacts of the pandemic. Green, renewable and smart technology reliant sectors are also seen as promising sectors for PPPs in the future by the survey respondents. These include agriculture (food security); digital infrastructure (improved broadband, systems supporting e-commerce, ITC, etc.); renewable power and energy; transportation (green and alternative transportation modes that improve mobility); and education (especially remote learning platforms). It is of concern that tourism / leisure, which are drivers of growth and a mainstay of economic activity in emerging economies, was seen as a less attractive sector by respondents. However, the need for green tourism was mentioned.

Additional comments that were made about the sectors that are most promising include the following:

- Projects that have an immediate impact on economic growth should be considered.

- Resilient and sustainable projects should be a priority for the future (i.e. climate friendly projects).

- Local governments should have a voice in national project priorities, not just the central government.

- Improving relationships with investors who are interested in sustainable projects is important.

- People friendly projects that generate employment opportunities are needed.

- Projects that promote national self-sufficiency should receive attention.

- Ensuring resilience of projects is imperative.

- There should be a focus away from mega-projects for the time being.

Question 4: Help Needed from Development Banks, Donors, Investors, and Developers for PPP Programs During Economic Recovery

Survey respondents from the public and private sectors, and academia shared their ideas on what help is needed from (banks and donors) to help PPP projects / programs weather and recover from the impacts of the pandemic. Suggestions included the following:

- Additional Technical support – the provision of technical assistance to help overwhelmed PPP units; support that improves knowledge transfers; providing advisory support to contracting authorities that addresses new procurement realities; offering technical support to revisit project financial models; and helping with improving feasibility studies.

- Fast Tracking Capacity Building – providing support to strengthen PPP programmatic offices (units) and retraining their staff for new challenges; and additional institutional capacity building that helps with knowledge transfers.

- Supplementing Financial Support – development of new and innovative project development funds to assist with project financing and liquidity; restructuring of debt repayment schedules; providing bridge loans; postponing of short-term debt obligations (6 months to a year) on a case-by-case basis for PPP projects with considerations of grace periods and credit enhancements; refinancing projects if necessary; exploring competitive financing solutions; providing direct financial support to sectors that are most impacted (i.e. tourism and transportation); and providing compensation for losses and higher costs.

- Enhancing Stakeholder Collaboration – making decisions together with improved communications between parties; improving trust between the public and private sectors.

- Improving Communication – improving communication channels between project partners; and keeping all funders/financiers of projects informed about decisions made by the greater PPP teams.

- De-Risking Projects – finding ways to de-risk investments (possible through new de-risking tools and better risk assessments) thereby reducing costs of entry and interest rates; providing grants for better feasibility and due diligence studies and project preparation; addressing currency risk in volatile situations; and offering support for international guarantee packages and trust funds that could attract investors.

- Guaranteeing Packages for Force Majeure Events – exploring and developing project clauses measure that would cover future pandemic force majeure events (improved insurance for force majeure); suspending punitive penalties for non-performance during the pandemic.

- Improving PPP Project Contracts – exploring innovative types of PPP contracts that are more flexible regarding unexpected catastrophic events.

- Cultivating PPP advocacy – between the public and private sectors; stakeholders, and political interest groups; and developing new funding ecosystems and environments that are conducive to investment in a post-covid-19 environment.

- Reprioritizing PPP Programs and Pipelines – Helping authorities to develop sustainable and resilient projects in new priority areas through conservative and pragmatic planning; improving tools that can truly assess the health of current projects; restructuring projects to match new realities and exploring new ways to incentivize investors; helping developing ways to avoid meritless projects; and focusing on projects that improve the livelihood of people.

- Helping Develop Targeted PPP Reforms in countries supported by new responsive guidelines and revised legal frameworks.

- Improving and Refining Project Procurement and Management Best Practices – introducing new performance assessment tools; identifying key failures and avoiding them in the future; improving transparency and competitiveness in PPP procurements; improving ways to deploy PPP project procurements; and improving contract negotiations.

- Embracing Innovation Incentivization – developing metrics to evaluate innovative ideas to repurpose present and future projects and incentivize out of the box solutions.

It was evident that financial support and relief actions were the most sought after short term requests. However, longer terms needs were focused on improving the selection and implementation of PPPs that are people focused, inclusive, and future-forward looking in terms of sustainability and resilience.

Question 5 – Positive Opportunities in a Post-COVID-19 Pandemic Era for a New Approach PPP Paradigm in the Next Few Years

In this section positive opportunities (recommendations) related to new approaches to PPPs in a post-COVID-19 world were shared by respondents. A few respondents said it was too early to provide answers to this question. It was felt that the pandemic aftermath will lead to opportunities that:

- Enhance and Improve PPP contracts – especially in the areas of force majeure impact actions stipulated in contract clauses; more flexible contract provisions that enhance project “survival” by allowing proactive mitigations in a crisis; and slimmer and more streamlined contracts.

- Implement legal reforms that embrace new sustainable PPP policies and limit bureaucratic barriers that hinder innovative, flexible, robust and responsive PPPs.

- Streamline and introduce mandatory planning, procurement and implementation of future PPP projects – with referencing to improved assessments of project feasibility, value for money, value for people, value for the future, sustainability, and resilience; enhanced project selection criteria that are tied to sustainable development goals; and enforcement of robust streamlined feasibility studies that will allow the selection of meritorious, viable and resilient projects.

- Change social contracts and increase the focus on People First PPPs.

- Pioneer paradigm shifts in ways that governments will implement PPPs in the future; and critical thinking about why PPPs are chosen as a procurement option.

- Redefine PPP priorities that will focus on economic recovery and achievement of the SDGs.

- Highlight the increasing importance of a new generation of smart projects – especially in healthcare, education and IT sectors.

- Herald in a preference for smaller projects – instead of large risky mega-projects.

- See a geopolitical leveling of the playing field between the North and the South – caused by innovation and technological leap-frogging.

- Demand greater collaboration between domestic and international investors and stakeholders; and redefining what partnerships mean in PPPs.

- Allocate of project risk better – with improved approaches to due diligence on project risk profiles; recalibrated insurance models and a redefined approach by insurers such as MIGA.

- Necessitate financial reforms – that recognized the potential of future shocks to the world’s economic systems; and improved financial regulations regarding financing of PPP projects; and the introduction of refinancing flexibility and new financial models, products, new investment approaches.

- Improve dialogue and collaboration between the public and private sectors due to dwindling resources and the need to leverage existing resources.

- Adopt lessons learned during the pandemic to improve the practice of PPPs by PPP professionals (especially in crises management and shared decision making.

- Encourage more and improved cross-border (transnational) PPPs that integrate economies in the globalizing world.

Closing Comments

Although one would expect that many respondents would be jaded by the current impacts of the corona-virus pandemic, it was interesting to note a pragmatic enthusiasm for PPPs. However, respondents made it clear in their responses that the way of doing PPPs has changed and that PPP programs are facing a paradigm shift. Practitioners pointed out that it is time for refocused and more relevant projects, that are more defensible, sustainable and resilient, and which include improved collaboration and cooperation between the public and private sectors in redefined partnerships.

I would like to thank the survey participants who contributed amazing insights and shared their thoughts with me. Feel free to share the link with your colleagues. Please feel free to reach out to me at baxterintdev@gmail.com if ever you want to chat about PPPs.

Post-Script

Imad Fakhoury – Global Director, Infrastructure Finance, PPPs & Guarantees Global Practice at the World Bank – recently published a blog titled – How the World Bank is looking at COVID-19 and Public Private Partnerships, Right Now and Post Crises – see link below – https://blogs.worldbank.org/ppps/how-world-bank-looking-covid-19-and-public-private-partnerships-right-now-and-post-crisis?cid=ECR_TT_worldbank_EN_EXT

The blog was the result of a marathon brainstorming sessions with national public sector bodies (PPP units and government representatives) across the globe to get a sense of how COVID-19 is affecting their PPP programs. It is interesting to note that over the same time period I had launched my survey which was focused on both public and private sector practitioners.

Imad provided feedback that supports the findings of my survey. A summary of his observations is provided below (many of which corroborate my findings):

- Short term – temporary disruptions of demand and operations are leading to revenue losses for PPPs……The same is true for delays in construction schedules due to supply-side issues like labor, equipment, and raw material disruptions for projects under construction.

- In the medium term, we anticipate a lasting downward trend in revenues from operating projects, adverse impacts on access to financing for those yet to reach financial close, and disruption of construction schedules of projects already underway.

- Short-term losses may be recouped with private operators relying on revenue reserves and the fixed component of their payments from long-term service and offtake contracts—and by slowing down non-essential investments. In fact, where project schedules have built in lags for risk events, schedules may recover without lasting impact on project fundamentals.

- Force majeure, compensation, and change-in-law clauses might apply depending on each case’s circumstances.

- These impacts can be mitigated with modest success through force majeure and compensation clauses, using bridge financing, capital injections, renegotiation of key project parameters, and introduction of regulatory flexibility on performance indicators, among other measures. If the pandemic’s impacts are limited to the short or medium term, project credit risk and access to financing may not change substantially.

- I have two words of advice to governments: stay vigilant. We recommend that they review their PPP and state-owned enterprise (SOE) infrastructure portfolios to identify where financial risks are largest and what’s at stake in terms of service delivery if projects underperform or enter financial distress. They should identify options to safeguard the continued delivery of critical infrastructure services while managing fiscal impacts.

- Long-term – The reality is that we need more resilient PPP and contractual frameworks going forward. PPPs, as a means to deliver infrastructure, are in constant evolution, as is governments’ capacity to effectively procure and implement them. Continued focus on the development of infrastructure as an asset class will help move this along.